A Self-Managed Superannuation Fund (SMSF) is a retirement savings vehicle for its members. The main difference, however, is that unlike retail and industry super funds an SMSF gives trustees greater control over their retirement planning. The members of an SMSF are trustees and they have control over how they choose to tailor the investment strategy of the fund to meet their retirement needs. SMSFs allow greater control over the asset classes you can invest in and can provide additional tax efficiencies and flexibility to its members.

SMSFs aren’t the right fit for everyone and it is best to speak with a qualified, licensed professional before making the major financial decision to establish an SMSF. We offer an end to end solution (assisting with and managing all the complexity involved) and would be more than happy to discuss your interest in establishing an SMSF as part of your retirement wealth building strategy.

Superannuation is an investment strategy for your future as it accumulates funds for your retirement. Employers are required to pay at least 9.5% of your salary as superannuation guarantee contributions into your nominated account and it is compulsory to have a super fund when working. Your superannuation fund is likely to be one of your biggest assets in your portfolio and will be an important source of income for you after you stop working. Careful planning now with the right investment advice can help you maximise your benefits for the future.

Most Australians need more than the age pension to have a comfortable lifestyle in retirement. Seeking advice now will make a huge difference to your lifestyle in the future which will provide you with clarity and peace of mind.

Natural, personal and financial disasters are now a part of everyday life. It is more important than ever to ensure that you are not left vulnerable by covering yourself and your family with insurance protection. When you are in the process of building wealth, you must also be able to protect it. We can help tailor insurances for you in the areas of:

- Life Insurance

- Total & Permanent Disability (TPD) Insurance

- Critical illness / Trauma Insurance

- Income Protection Insurance

- Business Expenses Insurance

- Key Person / Buy-Sell Insurance

For example, income protection insurance will keep you in your own place, pay the car loan and the groceries until you recover. Insurance is affordable and gives you the confidence that you can retain independence even if the worst happens. You must weigh up the cost of insuring yourself versus the cost of not insuring yourself.

Determining what investments to capitalise on can be a daunting task. We will tailor your investment portfolio to suit your risk profile and ensure that you remain comfortable with your decision. Asset allocation involves dividing your money between different types of assets such as cash, bonds, shares, property and other alternatives.

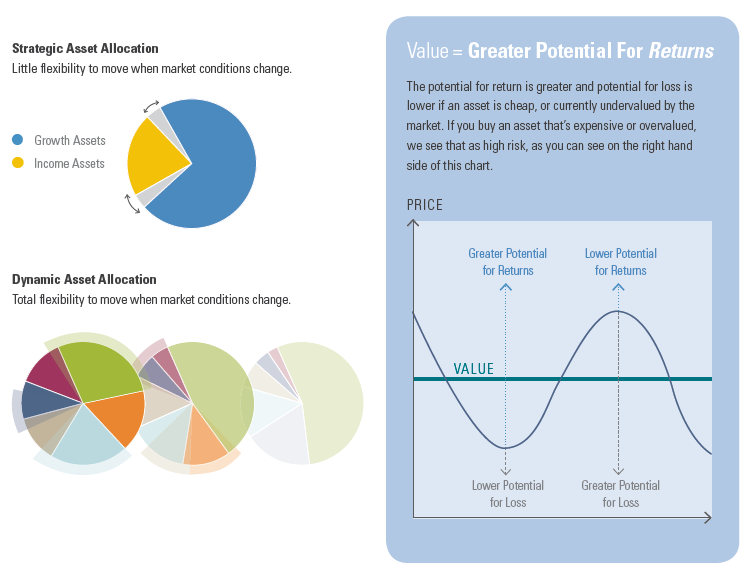

More traditional (or strategic) asset allocation involves setting an asset mix for the long-term with occasional changes to how much is invested in each class.

Dynamic asset allocation, on the other hand, involves more frequent portfolio changes so that it can react to differences in market conditions. Reacting to changes generally involves reducing the amount held in the best-performing asset class, while adding to the amount held in assets that are underperforming. The aim is to reduce the effect of the ups and downs of the market to the value of your money; and achieve returns that exceed average performance.

Cashflow Management or budgeting is the process of creating a plan to spend your money. Creating this spending plan allows you to determine in advance whether or not you will have enough money at a certain period in time. If you don’t have enough money once your income and expenses have been input into the plan, then you can use this planning process to prioritize your spending and focus your money on the things that are most important to you. We keep you accountable for your spending habits and help you learn the benefits and skill of saving first and spending within your means.

As Australians are now on average living longer, superannuation needs to stretch even further to cover living expenses. Will your money last as long as you live? Planning now and choosing the most appropriate superannuation structure may be crucial to achieving your desired lifestyle in retirement. Making the most of your assets with a range of tax and contribution strategies is an effective income generator for retirement. Maximising the benefits of your superannuation is critical to growing your wealth for retirement. This can include establishing an SMSF if it is suitable to do so, salary sacrificing and after-tax contributions.

When planning your retirement in Australia, you need to consider the benefits of transferring your pension from the United Kingdom to Australia if you satisfy the criteria set by the HMRC. You also need to give consideration to developing a long-term relationship with a financial adviser in Australia to ensure you are kept abreast of legislation changes and that your overall financial advice needs are met. Due to legislation changes introduced in the UK, from 6th April 2015, UK Pension transfers to Australia moving forward have been limited to only those who are aged 55 or over.